Putting the tools for help in your hands

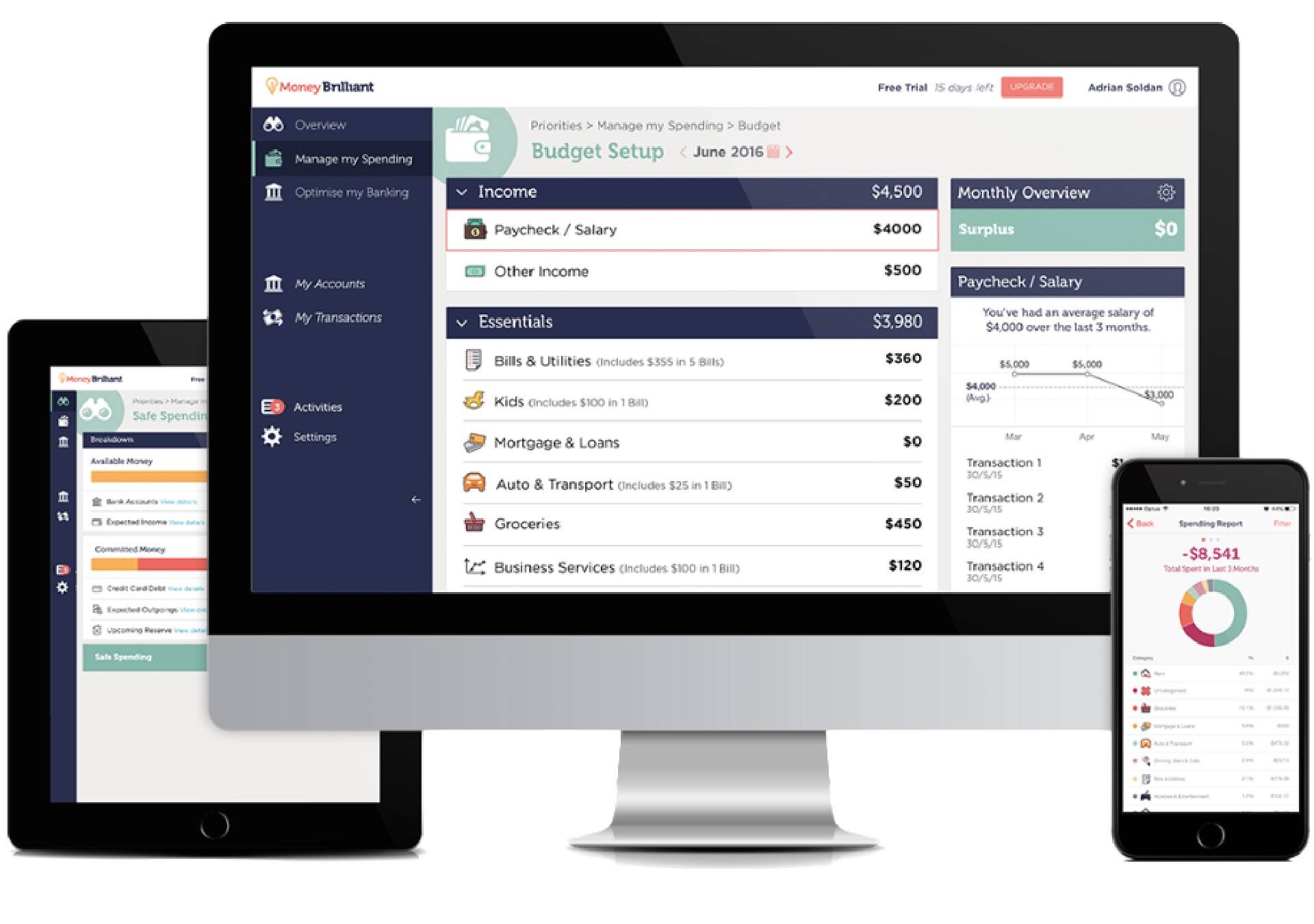

MoneyBrilliant puts the tools for better money-management in your hands – allowing you to connect bank accounts, credit cards, loans, mortgages, investments, superannuation and even loyalty cards from thousands of world-wide financial institutions, for a complete picture of your money - accessible across desktop, tablet and smartphone.

Create budgets, track cashflow, set up bill reminders, record receipts automatically for tax-time, and access to personal insights and recommendations on where and how you can save money are all part of how MoneyBrilliant can make managing your money easier. It is like your own personal financial assistant – you’re the boss, but MoneyBrilliant has got your back.

Connecting you to thousands of world-wide financial institutions.

At home, or on the go, from your mobile, tablet or desktop.

Highly secure encryption from Yodlee to help keep your data safe.

Including the COVID-19 Financial Survival Coaching Program & Guide.

How does it work?

MoneyBrilliant brings all your financial information together so you can see everything in one place. Once your financial information is all in one place it becomes easier to understand what you earn, what you spend and how you spend it. MoneyBrilliant then uses your information to provide you with insights about your money and suggestions that might help you manage it more effectively. You can also use MoneyBrilliant to set goals and track progress towards them.

COVID-19 Financial Coaching Program & Survival Kit

The COVID-19 Financial Survival Coaching Program is as part of the MoneyBrilliant Plus offer and guides you to:

- get a better understanding of your recent cash flow – both income and spending

- set a new budget including available government assistance and hardship relief available from businesses such as banks, energy companies and telecommunications businesses

- use all the tactics we’ve developed to squeeze spending across both Essentials and Lifestyle spending

- understand the advantages and disadvantages of things like mortgage relief offered by your bank and making an early withdrawal from your super

The Survival Kit is a free interactive easy-to-use PDF document that guides you through a 7-day program to deal with the financial challenges of COVID-19.

Keeping your money, data and personal information safe

MoneyBrilliant uses industry standard security technology, just like your bank, to protect your information and your money. When you connect your financial accounts and provide your login credentials these are passed directly, over a secure, encrypted connection, to a company called Yodlee. They are not stored or held by MoneyBrilliant. Yodlee stores these details using highly secure technology in separate databases using multi-layered hardware and software encryption.

Getting technical help and support

The MoneyBrilliant Help Centre has a range of frequently asked questions and online articles to provide you with information and instructions about MoneyBrilliant tools and features.

If you need further help or would like to report an issue you can contact MoneyBrilliant’s customer support staff who are available to help you whenever you have questions.

Email: support@moneybrilliant.com.au or you can submit a Help request through the app. You’ll get a response within one business day, but more likely even sooner than that.

Phone: 02 8014 8611 or 1300 41 40 84

Frequently Asked Questions

Where can I find my corporate offer code?**

Eligible AMP employees will have had this emailed to their AMP email address.

Can I upgrade my existing account to MoneyBrilliant Plus using the corporate offer code?

Yes. If you have received a corporate offer code, all you need to do is login using your existing username and password and navigate to Settings. From here, select Plan & Billing and enter your corporate offer code to validate your upgrade to MoneyBrilliant Plus.

Important information

* 2020 Mozo Experts Choice Money Management App Award Winner. For the 2020 Banking Apps & Technology category, Mozo considered all mobile applications that offered data connections to Australian banks and examined the cost, functionality, availability and effectiveness of each app assessed. Mozo analysed 77 banking apps. The award is given for the product that represents best value in their category.

**The AMP corporate MoneyBrilliant offer is open to all AMP employees including permanent full-time and part-time employees, as well as fixed terms contractors employed with AMP. This offer is not available to contractors employed through other entities and temporary employees. This offer expires 31 December 2020. Your unique offer code is for single use only which means it’ll expire once you use it to set up your account. Annual subscription to MoneyBriliant Plus costs $99 AUD as at 19 May 2020. Subscribers will be downgraded to MoneyBrilliant Basic upon expiry of the offer on 31 December 2020 or can retain their MoneyBrilliant Plus subscription by providing payment details.

MoneyBrilliant (ABN 34 153 932 766) is a money management app that is part owned by AMP New Ventures Holdings Pty Ltd (ABN 21 602 035 530) which is a part of the AMP Group. For information on how MoneyBrilliant handle personal information you can access their privacy policy online. For the terms of access for the app you can also access these online on their website www.moneybrilliant.com.au.

The information in this communication is provided by AWM Services Pty Ltd (ABN 15 139 353 496) and is general in nature only. AWM Services is a part of AMP Group.