Financial wellness describes how we manage our finances and cope with its related stress. It’s important because it can significantly affect our overall psychological wellbeing.

AMP’s recent financial wellness research found three money habits in common with people who are financially secure:

- They save money regularly

- They pay off their credit card debt

- They avoid using layby and buy now, pay later (BNPL) services.

We explore each of these in more detail to see how making a few small changes could improve your financial wellness.

Saving money regularly

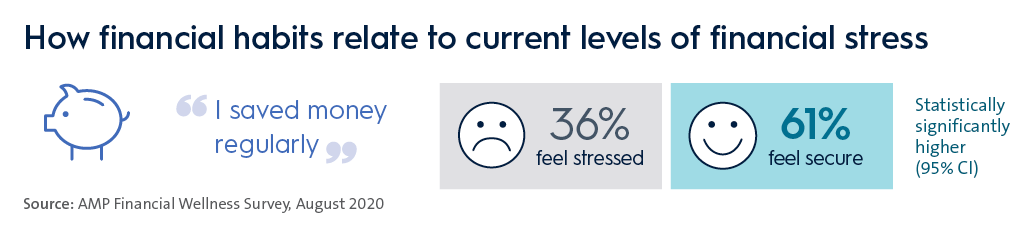

COVID-19 seems to have served as a wake-up call to many Australians to set financial goals and save for a rainy day. Before COVID, 61% of financially secure people said they saved money regularly, and on average, saved 25% of their gross income per week.

In comparison, only 36% of financially stressed people said they saved money regularly, and those who did save, saved 5% less per week than those who are financially secure.

What’s more, at 53% compared to 45%, women were found to be more likely than men to save money regularly, however not for retirement.

Tips for saving

If you’d like to save more money, a good approach is to set a target amount and system for saving.

For example, some people like to have a separate savings account to avoid accidentally spending their savings. It can be useful to set up an automatic direct debit on payday, so the target amount is transferred into the savings account straight away – helping to keep it out of sight and out of mind.

Avoiding credit card debt

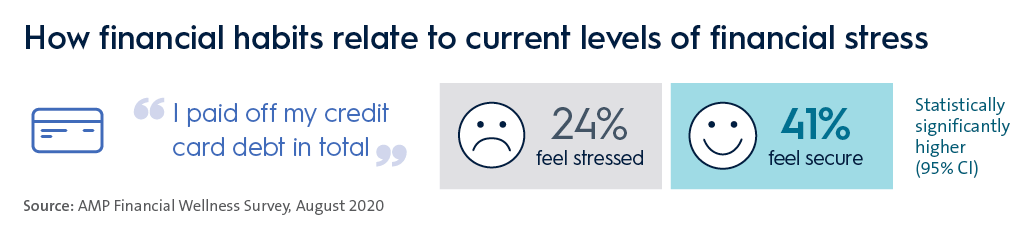

Rates of credit card debt were also found to be lower among the financially secure. Before COVID, 41% said they paid off their credit card in full each month, compared to 24% of financially stressed people.

Unfortunately, COVID has seen more Australians relying on credit cards, with 11% of those whose working hours were affected by the pandemic, using their credit cards to pay for expenses, compared to 3% of people whose working hours weren’t affected.

Tips for using credit cards

If you use credit cards, it’s important to read the fine print to understand the fees, charges and interest, including how and when they apply. Afterall, why spend money where you don’t need to?

To avoid extra interest charges, you could try to pay off your credit card in full each month, and if you feel your spending is getting out of control, you could ask your lender for a lower credit limit.

Avoiding buy now pay later (BNPL) and layby

Another hallmark of the financially secure is living within their means. Almost four times as many financially stressed people use layby or BNPL services – 19% of financially stressed people admit to using them compared to just 5% of financially secure people.

And women are almost twice as likely to use these services than men –7% of men say they use BNPL or layby compared to 13% of women.

Tips for using Buy Now Pay Later (BNPL)

As with credit cards, it pays to understand any fees and charges that apply. Before spending, make sure you can afford the repayments. Then, once you’ve incurred a debt, set reminders to make your repayments by the due date. It may also be helpful to link your BNPL account to your debit card rather than your credit card to make sure you’re making repayments with money you have, rather than incurring additional credit card debt.

Help to get control of your debts

There are a range of options to help you get on top of your debts.

- You could start by checking out our tips for managing your debts to improve your financial wellness.

- You could also speak to a financial adviser to have a personalised plan created to suit your circumstances. If you don’t have an adviser, find one near you.

If you’re struggling with financial stress or having trouble managing your debts, learn more about all the resources and support networks available within AMP and externally.

One of the resources is the National debt helpline. They provide guidance on how to manage your debts and finances. For free financial counselling, call 1800 007 007 or visit the National Debt Helpline.

Budget smarter

How to boost your retirement savings as super and tax laws change

29 March 2024 | Super If you’re looking to maximise your superannuation in the lead-up to retirement, it’s a good idea to be up to speed on any legal updates that could affect the super and tax landscape. Read more

Your super checklist for EOFY

14 June 2023 | Finance 101 With the end of financial year fast approaching, now is a good time to consider how you can use superannuation to maximise your tax benefits. Read more

Key points from the 2023-24 Federal Budget

10 May 2023 | Blog Find out how the 2023-24 Federal Budget proposals could affect you. Read moreWhat you need to know

Any advice in this article is provided by AWM Services Pty Ltd ABN 15 139 353 496, AFSL No. 366121 (AWM Services) and is general in nature only. It doesn’t consider your personal goals, financial situation or needs. It’s important you consider the appropriateness of any advice and read the relevant product disclosure statement before deciding what’s right for you. AWM Services is part of the AMP group and can be contacted on 131 267 or askamp@amp.com.au.

The information provided in this article is factual information only. It doesn’t contain any financial advice or make any recommendations about a financial product or service being right for you. If you want financial advice about what is right for you, we can refer you to a financial adviser.

This information is provided by AWM Services Pty Ltd (ABN 15 139 353 496), is general in nature only and hasn’t taken your circumstances into account. Before deciding what’s right for you, it’s important to consider your particular circumstances and read the relevant product disclosure statement or terms and conditions available from AMP at amp.com.au or by calling 131 267.

All information on this website is subject to change without notice. Although the information is from sources considered reliable, AMP does not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP does not accept any liability for any resulting loss or damage of the reader or any other person.

Read our Financial Services Guide for information about our services, including the fees and other benefits that AMP companies and their representatives may receive relating to products and services provided to you. All information on this website is subject to change without notice. AWM Services is a part of AMP group.